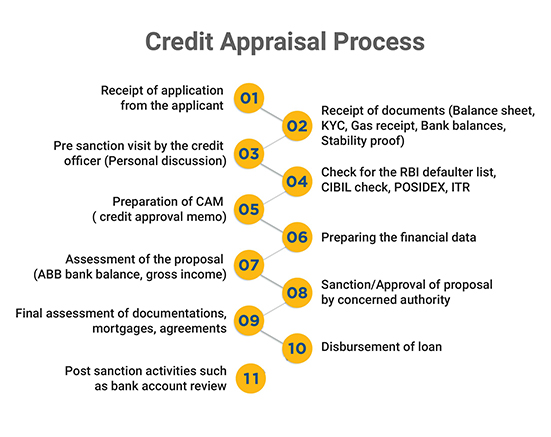

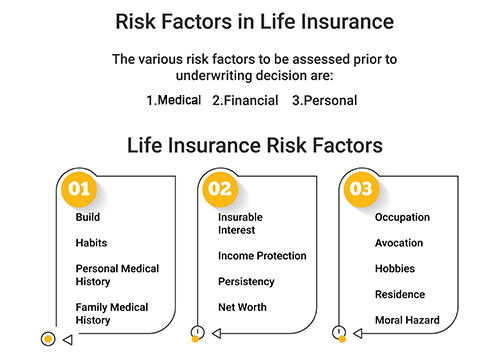

Credit appraisal or Underwriting in a Bank, Financial Services or an Insurance company is a risk assessment process of appraising the creditworthiness of someone applying for a loan or an insurance policy. To assess the credibility of the borrower, his sources of income, age, experience, number of dependents, repayment capacity, past and existing loans/policies, health, nature of employment and other assets are taken into account.

We at Writer Information support credit assessment and Underwriting activities within BFSI by providing “End to End Life Cycle Management. This means from the first-mile pickup, processing to the last-mile storage we are a One Stop Shop for the customers, and this gives us a competitive advantage. The services that form a part of this end-to-end journey include:

Rapid advances in technology help to collect, monitor, and disseminate information that have contributed towards the development of completely new modes of sustainability, when it comes to governance of the global commodity supply chains.

Benefits delivered:

It becomes convenient to predict consumer behaviour, build a strong customer base and develop the portfolio from there on.

Benefits delivered:

Credit Underwriting integrates the client’s strategic business objectives by streamlining the credit processes. The operational benefits delivered include:

Credit underwriting as a tool helps to improve the overall efficiency of credit risk management in the volatile financial domain.

Managing risks is a major concern when it comes to financial services industry of all sizes. This is where proper implementation of all possible financial intermediation comes into the picture. This can be achieved through: